“We’re breaking ground next month. When should we start thinking about branding?”

This question from a Dallas developer came 18 months after we recommended starting the brand strategy process. His 240-unit development was already locked into architectural plans, amenity selections, and unit configurations—all made without brand consideration.

The result? Six additional months of lease-up time trying to force generic positioning onto a property that could have commanded premium rates with strategic brand planning.

Timing isn’t everything in multifamily branding—it’s the only thing.

As multifamily branding specialists who’ve guided developments through every phase from concept to stabilization, we’ve learned that when you start matters as much as what you do.

The Critical Timing Problem

Most developers think multifamily marketing begins 6 months before opening. In our experience, developments that achieve fastest stabilization start their brand journey much earlier—and follow a specific sequence that most developers never consider.

The Compounding Effect: Each brand decision builds on the previous one. Start too late, and you miss opportunities that can’t be recovered later.

What We Consistently Observe: Properties that begin strategic brand planning during early development phases dramatically outperform those that treat branding as a pre-opening checklist item.

But here’s what most developers don’t realize: There are four critical decision windows where brand strategy must happen. Miss any of these windows, and you limit your positioning options permanently.

Window #1: The Foundation Decision Point

When Most Developers Miss It: 18-12 months before opening, when major development decisions are still flexible.

Why This Window Matters: This is when your brand should influence actual development decisions—not just marketing materials. We’ve worked with developers who discovered their optimal positioning required different amenity packages, unit configurations, or even architectural elements.

The Strategic Opportunity: There’s a specific research methodology that reveals not just who your competitors are, but where the white space positioning opportunities exist in your market. This intelligence should guide development decisions while they’re still changeable.

Real Example: AVEN DTLA’s early brand strategy influenced everything from lobby design to rooftop programming, creating a cohesive experience that supported premium positioning against 2,000+ competing units.

What Happens If You Wait: We consistently see developers discover optimal positioning strategies that can’t be fully executed because the physical environment has already been designed.

Window #2: The Identity Formation Phase

The Critical Timeframe: 12-6 months before opening, when brand identity transforms strategy into tangible creative direction.

Why Developers Underestimate This: Most think logos can be designed in a few weeks. Strategic property branding identity requires months of development, testing, and refinement to support premium positioning.

The Hidden Complexity: Effective identity development isn’t just creative work—it requires trademark research, market validation, and integration planning across dozens of future touchpoints.

What We’ve Learned: Developments that allow adequate time for identity development achieve significantly more cohesive brand implementation than those rushing this phase.

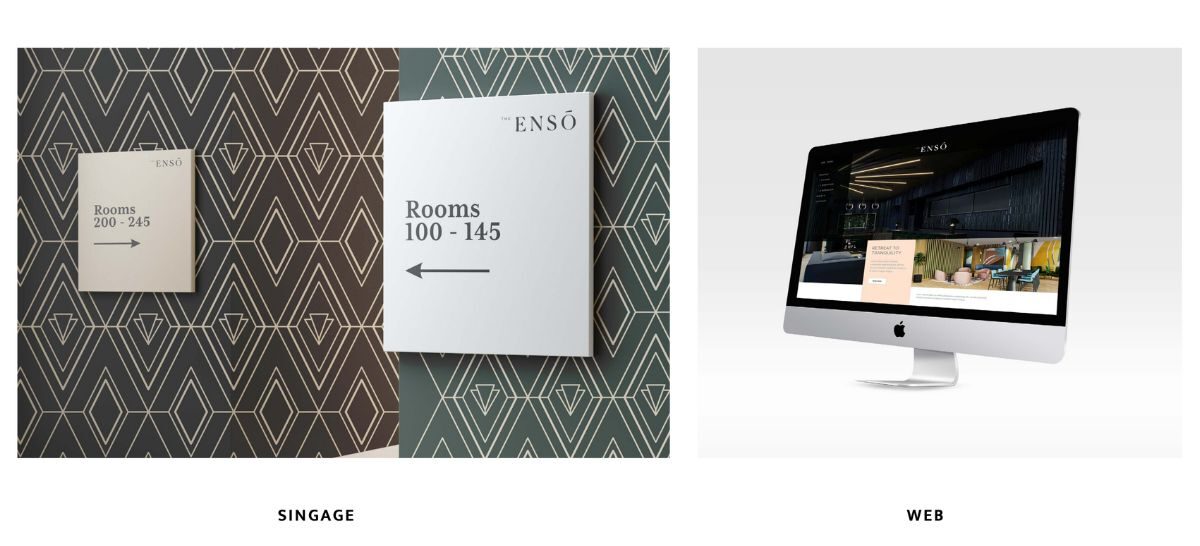

The Integration Challenge: Your brand identity needs to work seamlessly across physical signage, digital platforms, leasing materials, and community spaces. This level of coordination requires strategic planning most developers never consider.

Window #3: The Implementation Sprint

The Make-or-Break Period: 6-3 months before opening, when brand strategy becomes the actual materials and experiences prospects will encounter.

Where Most Developments Fail: Rushing material development without proper brand foundation leads to inconsistent messaging and missed positioning opportunities.

The Coordination Challenge: Apartment marketing strategy requires dozens of coordinated elements—website, collateral, training materials, advertising campaigns—all aligned with strategic positioning.

What We Consistently See: Developments that begin this phase with incomplete brand strategy struggle to create cohesive market presence.

The Training Gap: Your leasing team needs time to understand and articulate your brand positioning effectively. Most developers underestimate this crucial preparation phase.

Window #4: The Launch & Optimization Period

The Activation Phase: 3 months before to 6 months after opening, when all previous brand work gets activated through coordinated campaigns and community engagement.

The Strategic Sequence: Developments that achieve fastest lease-up follow a specific launch sequence that most developers never learn about.

The Optimization Opportunity: Early market response provides crucial data for refining brand messaging and positioning. There’s a systematic approach for using this intelligence to accelerate velocity.

What We’ve Observed: Properties that treat grand opening as strategic brand activation rather than just marketing events create lasting competitive advantages.

The Timing Mistakes That Cost Months

Starting Strategy Too Late

The Pattern: Beginning brand development 6-9 months before opening, after major decisions are locked.

The Cost: We consistently see this add significant time to lease-up periods because positioning options become severely limited.

Rushing the Creative Process

The Pattern: Attempting to complete identity development in 2-3 months due to timeline pressure.

The Impact: Generic creative solutions that don’t support strategic positioning or market differentiation.

Launching Without Complete Systems

The Pattern: Starting pre-leasing with inconsistent messaging or incomplete brand materials.

What We Observe: Confused market perception and missed early momentum that’s difficult to recover.

The Strategic Timeline Advantage

In our experience, developments that follow the optimal brand timeline consistently achieve:

Stronger Market Position: Early brand strategy allows for differentiated positioning that competitors can’t easily copy.

Faster Lease-Up Velocity: Complete brand systems support more effective marketing and clearer prospect communication.

Premium Pricing Support: Strategic positioning developed over proper timeframes commands higher rents throughout the asset lifecycle.

Operational Efficiency: Consistent brand systems reduce ongoing marketing costs and improve team effectiveness.

Is Your Timeline Optimized?

Every development timeline is different, but the sequence of critical brand decisions remains consistent. The question is: Are you making these decisions at the right time?

Assessment Questions:

- How far are you from projected opening?

- Which development decisions are still flexible?

- Do you have strategic brand foundation in place?

- What competitive challenges exist in your market?

Most developers discover they’re missing crucial timing opportunities that could significantly impact their market performance.

Get Your Strategic Timeline Assessment

Don’t let poor timing limit your positioning options or extend your lease-up period. Our multifamily development branding process optimizes impact regardless of where you are in the development cycle.

Ready to optimize your brand development timing? Power Your Brand →

- AVEN DTLA: Strategic early-phase planning supporting premium market position

- The Fitz on Fairfax: Mid-development optimization that cut through market saturation

- True Connection Communities: Timeline coordination that accelerated successful rebrand