Sober-Curious Millennials & Gen Z Fuel Dry January

Key Consumer Shifts for the Beverage Industry

Now that “Dry January” 2024 has come to an close, key metrics and moments signal continued explosive growth for non-alcoholic “mindful drinking” alternatives aligned with younger generations increasingly seeking balance beyond the first month of the year.

As bars, restaurants, and beverage producers assessed opportunities to capture rising demand through sophisticated new offerings during January’s hype, our researchers kept a pulse on consumer motivations and market forces set to propel the alcohol-free sector well past this temporary sobriety challenge.

Let’s explore key data detailing changed preferences amongst newly sober-curious demographics like trends in premiumization, expanded occasions and changing values correlated to reduced drinking levels that forecast additional opportunity for hospitality brands catering to moderation migration. Read on to explore the potential for bars, restaurants, and beverage producers to embrace changing motivations through tempting menus and ingredient innovation.

Key Consumer Shifts

Moderation Goes Mainstream

Over 1/5 of respondents to a 2022 US survey planned to continue cutting back on drinking in 2024, showing an ongoing mindset shift valuing moderation.

This suggests a meaningful segment permanently adjusting consumption levels regardless of age. With multiple generations skewing toward wellness, this creates product implications around portfolio breadth, ingredients, and responsible branding.

Cultural Momentum Sparks Discovery

Despite the 13% increase in Dry January participation, most adopt “damp drinking” approaches either periodically abstaining or just reducing intake. This nuance provides wide latitude for hospitality brands creatively capturing interest.

Rather than an either/or scenario of drinking vs. not drinking, most find balance through temporary breaks and lowered volumes long-term. This favors operators offering exciting alcohol-free options while still catering to drinkers in an inclusive environment.

How is Dry January Driving Discovery

The annual Dry January challenge continues explosive growth introducing new people to temporary sobriety. Many leverage the moment through specialty menus and influencer partnerships, turning trial into year-round sales.

Smart marketing drives discovery without demonizing drinkers, while sophisticated new non-alcoholic spirits from Salcombe, Stryyk and Curious Elixirs answer demand for premium choices not sacrificing taste.

This presents an interesting crossroads where the growth of high-quality N/A spirits minimizes tradeoffs for skipping alcohol, even as drinking remains prevalent culturally. Reframing the dialogue around balance over prohibition protects hospitality revenue streams while appealing to moderate consumers.

Future Growth Trajectory

Experts confirm mindful drinking trends will extend far into the future, permanently redefining consumer behavior for new generations. There is no better time for all industry players to explore exciting possibilities at the intersection of wellbeing and hospitality.

How to Capitalize on This Trend:

Bars & Restaurants

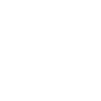

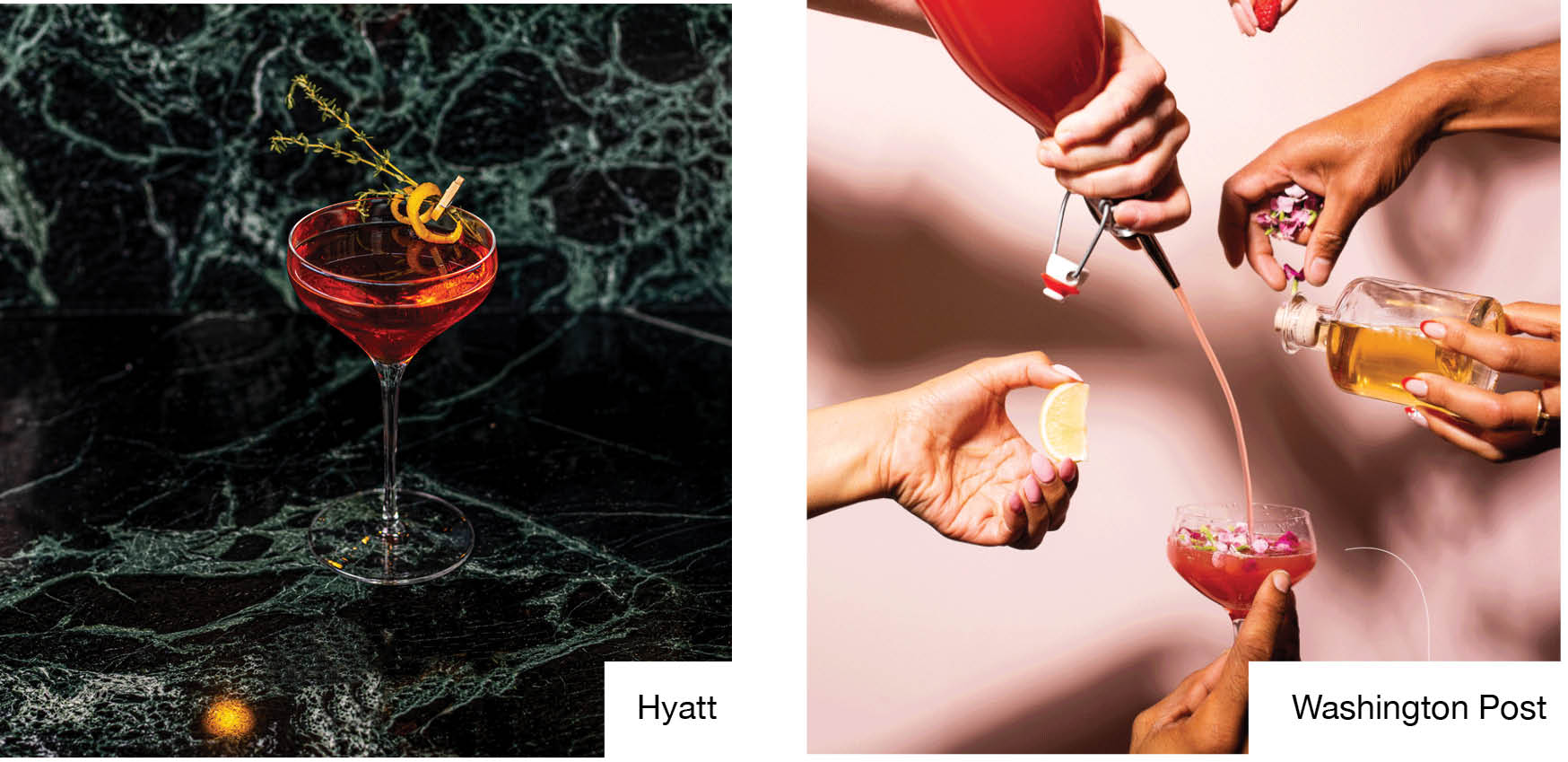

- Hire dedicated mocktail mixologists to craft sophisticated alcohol-free menus

- Host sober events like Dry January kickoffs or alcohol-free trivia nights

- Spotlight new ingredients like botanicals, teas, and nootropics

- Train all staff on mindful drinking culture to avoid alienating consumers

- Provide N/A options across beverage categories – beer, wine, spirits

Beverage Producers

- Lead with ethical supply chain stories and clean ingredients

- Democratize N/A varieties across price points for wide accessibility

- Explore novel global flavors drawing interest from booze-filled counterparts

- Educate hospitality partners on cooking with sophisticated bases

- Align with influencer and drinking culture authorities

Mindful drinking’s impressive growth reveals evolving consumer relationships with alcohol – presenting opportunities for businesses creatively aligning with wellbeing motivations.

Targeted positioning, product development, and marketing activation remain imperative to capture expanding yet nuanced demand for sophisticated non-alcoholic choices. While the analysis explores overarching trends, tactical needs will vary by business model, location, demo niche and more warranting personalized strategies.

Uncomn specializes in data-driven market research tailored to specific hospitality sectors, leveraged to inform creative business building solutions.

Let us uncover insights to inform your brand’s next moves by:

- Custom analysis of your consumer base

- Competitor opportunity assessment

- Strategy roadmapping